This simplicity makes centralised exchanges notably appealing for users unfamiliar with personal keys and navigating blockchain networks. The exchange controls the personal keys, which means they’ve custody of your belongings. While this makes it simpler to handle and commerce your crypto, it additionally opens you as a lot as the dangers of a 3rd party controlling your coins. CEX wallets are built into the trade; any cash held there are in a CEX pockets by default. With dozens of platforms to pick from, discovering the best site to swap your cryptocurrencies can be as daunting as launching.

When choosing a crypto exchange, check its popularity and security measures, like two-factor authentication and cold storage. Compare charges, deposit, and withdrawal choices, similar to financial institution transfers or PayPal, to search out what works finest for you. Yes Exchange (organized market), Impartial Reserve provides accounts for businesses, including SMSFs and trusts.

The Best, Most Secure Ways To Retailer Your Cryptocurrency: What You Want To Know

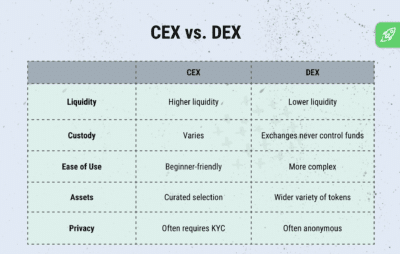

As An Alternative of an organization holding your funds and matching trades, DEXs use good contracts on blockchain networks to facilitate buying and selling between users. As of August 2023, the buying and selling quantity on decentralized exchanges has skilled notable growth. Hybrid exchanges, which merge features of centralized and decentralized platforms, offer customers each excessive liquidity and asset control. Centralized exchanges (CEXs) require customers to trust a 3rd get together to facilitate transactions, not like decentralized exchanges where customers trade instantly. This mannequin offers convenience, speed, and safety, making CEXs dominant in the crypto market by simplifying the buying and selling journey and managing the entire transaction process.

Disadvantages Of Cexs

- 5 years of expertise in crypto analysis of writing sensible blockchain and crypto analysis on Medium.

- Conversely, DEXs leverage blockchain technology and smart contracts to supply enhanced safety via decentralization and user-controlled asset management.

- The regulatory environment for cryptocurrency exchanges continues evolving rapidly, creating a posh international patchwork of compliance necessities that significantly impact user experience.

- DEXs are based mostly on blockchain transactions, which can be slower as a end result of community site visitors and block affirmation instances.

- Sensible contracts facilitate trading on DEXs by automating order execution, allowing users to trade directly from their wallets while sustaining greater management and safety.

A centralized crypto exchange is owned, operated, and managed by a single, for-profit entity. This company runs the exchange, settles disputes, and ensures that each one transactions are processed smoothly. These are the ‘classic’ charges you pay to crypto exchanges to both swap crypto and convert crypto to money (CEXs). A centralized trade, or CEX, is run by an organization or a group of individuals. They also act as both brokers and custodians for crypto individuals.

Which Is Cheaper To Trade?

This trade-off between convenience and duty is fundamental — knowing this helps you resolve which change aligns better together with your consolation degree in managing risk. Nevertheless, you can commerce stablecoins, which are backed by and mirror the price https://www.xcritical.com/ of certain fiat currencies. To hook up with a DEX and get on-chain, merely connect your self-custody wallet (like tastycrypto) to the internet site internet hosting the DEX after which proceed to swap. Safety, pace, and charges are, indeed, essential, however it’s essential to consider the next features to resolve the suitable swap supplier. Yes, You can entry DEX trading on the OKX app, which offers superior trade execution and unlocks a vast range of latest alternatives.

Understanding these value constructions empowers merchants to make more knowledgeable selections and maximize profitability in crypto buying and selling. Additionally, some CEXs supply reductions for paying fees utilizing native tokens (e.g., Binance’s BNB, OKX’s OKB). Be Taught what liquid staking is, the way it works, key benefits & risks, and the method to get began utilizing liquid staking tokens (LSTs) in DeFi protocols. MoonPay additionally makes it straightforward to promote crypto whenever you determine it’s time to cash out.

They give users full control over personal keys, not like CEX platforms. The first time many people interact with crypto is through a cryptocurrency exchange. The only distinction is that crypto exchanges deal in cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Decentralized exchanges eliminate difference between cex and dex counterparty threat by allowing customers to maintain custody of their property, but introduce completely different safety issues centered around technological execution.

Nonetheless, they rely upon good contracts, which can be vulnerable to bugs or exploits. CEXs listing a broad range of trading pairs, including main and minor coins, with fast listings after due diligence. This variety appeals to traders seeking various crypto assets supported by regulatory compliance. DEXs have decrease liquidity because they depend on consumer swimming pools, or AMMs, to distribute danger. Whereas slippage can happen for giant trades, it reduces concentration threat, with no single point of failure for person funds, although smart contracts may be susceptible.